Jonathan Dodd’s latest column. Guest opinion articles do not necessarily reflect the views of the publication. Ed

There’s a scene in one of the last Harry Potter films, where gold cups just double, reproducing themselves at a rate that threatens to swamp everyone and explode the cave they’re in. That in turn reminded me of the old Disney film Fantasia, a heroic attempt to popularize both classical music and cartoon films in one package.

That’s the Sorcerer’s Apprentice, by Delibes, and it stars a young Mickey Mouse in a wizard’s outfit, having to do all the dirty work because he’s just an apprentice. He gets into trouble while the wizard’s away, conjuring up a spell that makes the brooms and mops fetch buckets of water and mop the floor to save him the bother.

Make sure you know where the exit is

Mickey forgot the first rule of survival – make sure you know where the exit is. He didn’t know how to stop the spell, and the place became overwhelmed with water and mops and buckets. Luckily the wizard came back to right everything just in time, and he seems to have decided that Mickey learned a good lesson from it.

I remember seeing the film many years ago. I’m sure it’s out on Blu-ray now, and it would be a good thing to see again, as an example of how far we’ve progressed since those heady days before the Second World War, when someone very clever managed to invent colour film. That changed the movie landscape just as much as the invention of microphones did not much more than ten years before.

Living in heady days indeed

Those people must have believed they were living in heady days indeed. I was listening this week to Desert Island Disks, with Bill Gates choosing his eight records and revealing fascinating facts about his life. He was born in heady days too, and owed everything to being ‘good at Math’. Computers had just become available, and his school bought one, but the teachers didn’t know what to do with it, so they asked the students who were ‘good at Math’ to have a go at programming it.

These students were so good at it that they produced all the software to run various systems in the school in no time at all. They also took over the teaching of programming, and then they were asked by lots of local businesses to help them get set up and debug their software. This must have been one of the first times in history when the geeks ruled.

Eradicate diseases and improve life chances for millions of people

Bill Gates told a touching story about being ‘below average at talking to girls’. His friend and Microsoft co-founder was a couple of years older, and had written a programme for timetabling, that made sure that Bill would be sitting with lots of good-looking girls in various classes. He recounted that he just couldn’t do it, and so the opportunities were mainly wasted.

Now, of course, he’s the richest man on the planet, but he’s the kind of person who would always know where the exit is, and he’s used it. Almost all of his money is now used to eradicate diseases and improve life chances for millions of people. He said that there hasn’t been a single case of polio reported now in Africa for over a year. The only places where polio still exists are Afghanistan and Pakistan, thanks to our enlightened comrades of the Taliban and various other freedom fighters, who shoot nurses trying to vaccinate.

No characters who you could like or identify with

I also watched a film this week, called The Big Short. It was a strange beast, because it wasn’t really a drama or a pseudo-documentary, and it definitely wasn’t a comedy. There were no characters who you could like or identify with, and everybody was either extremely stupid or extremely selfish or just taking advantage of the stupid and selfish people. It attempted to explain the crash back in 2008 by telling the true stories of just a few of them.

I’ll try to make this short and hopefully clear. It all started with banks realising they could make more money by lending money they didn’t have, to people who couldn’t afford it. This caused lots of people to borrow lots of money and buy houses. So the value of houses rose and more houses were built, and people were borrowing money on what the market was telling them they were worth. Whenever they ran out of money, they got another loan because their house was suddenly worth much more.

The proverbial lemmings

This was compounded by a complete collapse of regulation. Crucially, all these loans were treated as very good loans, because they were taken out against property. Nobody was checking anything, and everybody was getting rich. They didn’t want to ask the obvious questions, because they liked getting rich too much.

Various clever people made even more money by guessing what was going to happen to the markets too, and it all became so complex that the whole world managed to fool itself. I imagine it looked like the proverbial lemmings, dancing and singing as they rushed towards a precipice they couldn’t see because they didn’t want to.

Somehow managed to take his money

The plot of the film showed that one person realized what was going on. Instead of shouting it to the rooftops, which would probably have failed to make any impact anyway, he decided to bet on the housing market crashing. He offered huge amounts of money to various banks rather like in a betting shop. They all laughed at him, but somehow managed to take his money, offering him rather high odds.

A few other financial experts noticed what he was doing, and became persuaded that he was right, so they got in on the act too. Basically, they were betting that they would make a huge profit from the end of the world. And they did. Everything caved in and there would have been nothing left, had not various governments decided they had to bail out these banks with bewildering amounts of borrowed money, which we’ll never be able to repay.

History will decide

Nobody knows what the world might look like right now had this collective insanity not taken hold of us all. History will decide whether it would have been better to allow all the banks to default or not. I suspect that history will not forgive the governments and officials who allowed this situation to happen in the first place, and refused to take any of the actions that would have at least limited the damage.

There was one telling incident in the film when some of these investors got an interview with someone who worked for one of the credit rating agencies. I think it was Standard and Poor’s, but I may be wrong. She said that she knew lots of these loans were worthless, but still gave them Triple-A ratings because her company was ‘scared that the business would go to their competitors’.

Untold trillions the poorer

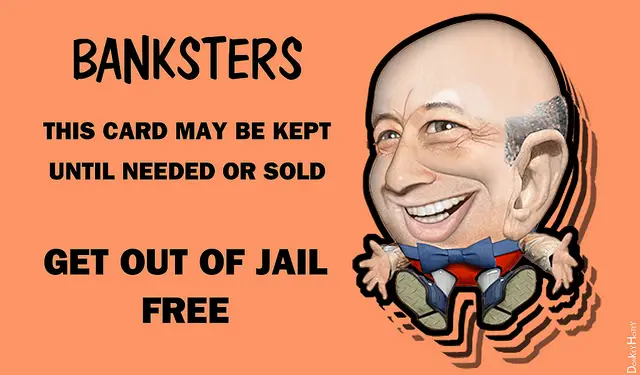

So we’re stuck with the same old banks, who have managed to refinance themselves and keep paying themselves their bonuses. And we’re also stuck with the same old credit rating agencies. We’re just untold trillions the poorer, and we’re having to cut social services to the bone.

And only one banker ever went to jail for it. I don’t even know if there’s a lesson to be learned from this sorry tale. I wonder whether any of those bankers and investors who profited hugely from the financial collapse ever thought of giving most of their money to eradicate diseases and improve life chances for millions of people.

Somehow I doubt it.

If you have been, thank you for reading this.

Image: anilmohabir under CC BY 2.0

Image: lorenjavier under CC BY 2.0

Image: methodshop under CC BY 2.0

Image: slasher-fun under CC BY 2.0

Image: thetaxhaven under CC BY 2.0

Image: public domain

Image: donkeyhotey under CC BY 2.0