Figures released by the Insolvency Service show the Isle of Wight has the highest level of insolvencies among 18 to 34 year-olds in the country.

The figures show the number of those becoming insolvent in that age bracket rose by a whopping 31.3% between 2015 and 2016.

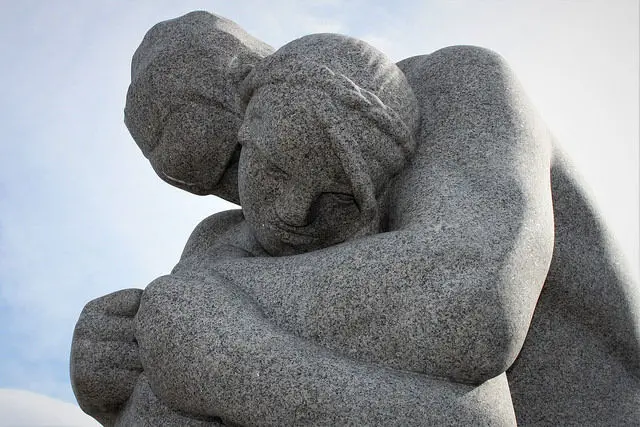

“At times I even felt suicidal”

The BBC have today featured the story of Daniel and Laura from the Island. They have accumulated debts of £30,000 and, despite Daniel working full time, struggle to survive. They say that at one point, they were living on just eggs, bread and milk because they couldn’t afford anything else.

Laura went on to tell the BBC that she’d felt suicidal and at times, “didn’t want to exist”.

Help from Christians Against Poverty

Luckily for Daniel and Laura, the Isle of Wight branch of Christians Against Poverty (CA) were on hand to provide invaluable help. Something which they say has “transformed their outlook”.

In fact, Daniel and Laura both agreed that CAP probably helped save her life.

The BBC report that Daniel is now in the process of declaring himself bankrupt. Laura has opted for a separate form of insolvency, applying for a Debt Relief Order.

High for other age brackets

Sadly, the problem is not just among young people. The Isle of Wight is also joint third with Scarborough for the highest overall rate of insolvencies in England and Wales.

the Insolvency Service report that for the first time since 2009/10, the number of insolvencies is on the rise.

Thanks to Jack Whitewood from Ventnor Exchange for the heads-up.

Source: BBC