The number of confirmed Isle of Wight Coronavirus (Covid-19) cases has increased from 189 to 194.

Anecdotally there have been more cases of Coronavirus in the community, with Island residents who are showing symptoms self-isolating.

The statistics

A total of 36 people have sadly died at St Mary’s Hospital after being tested for Covid-19. In addition, there have been 22 deaths outside the hospital setting.

As of 5th May, 25 people admitted to St Mary’s Hospital to have tested positive for Covid-19 have recovered and been discharged.

Find out more

A breakdown of national figures can be found on the Covid-19 Dashboard.

See OnTheWight’s explainer article on understanding the Covid-19 figures that are released by NHS England and Public Health England.

Residents continue to be urged to remain at home in order to stay safe and help the NHS save lives.

Government Covid-19 guidance: Stay alert and stay safe

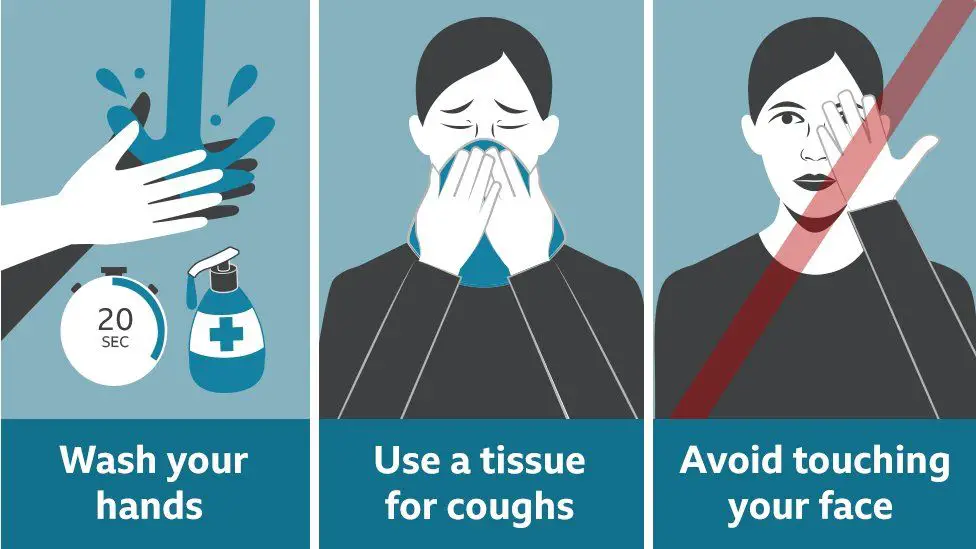

Wash your hands thoroughly and frequently (video tips).

Social distancing

It is recommended that you maintain at least a two metre gap (about 6.5ft) from people who are not from your household.

Seeking advice

Use the NHS 111 online coronavirus service that can tell if you need medical help and advise you what to do.