There’s been a lot of discussion about whether Gas and Oil companies should have to pay a windfall tax, after making record profits at a time when energy prices are pushing ever higher.

On Wednesday evening MPs had a chance to vote on it. The vote went against it (310 to 248), with 300 Conservative MPs voting no.

55 Conservatives were recorded as having ‘No vote recorded’, often the reason for this is abstention.

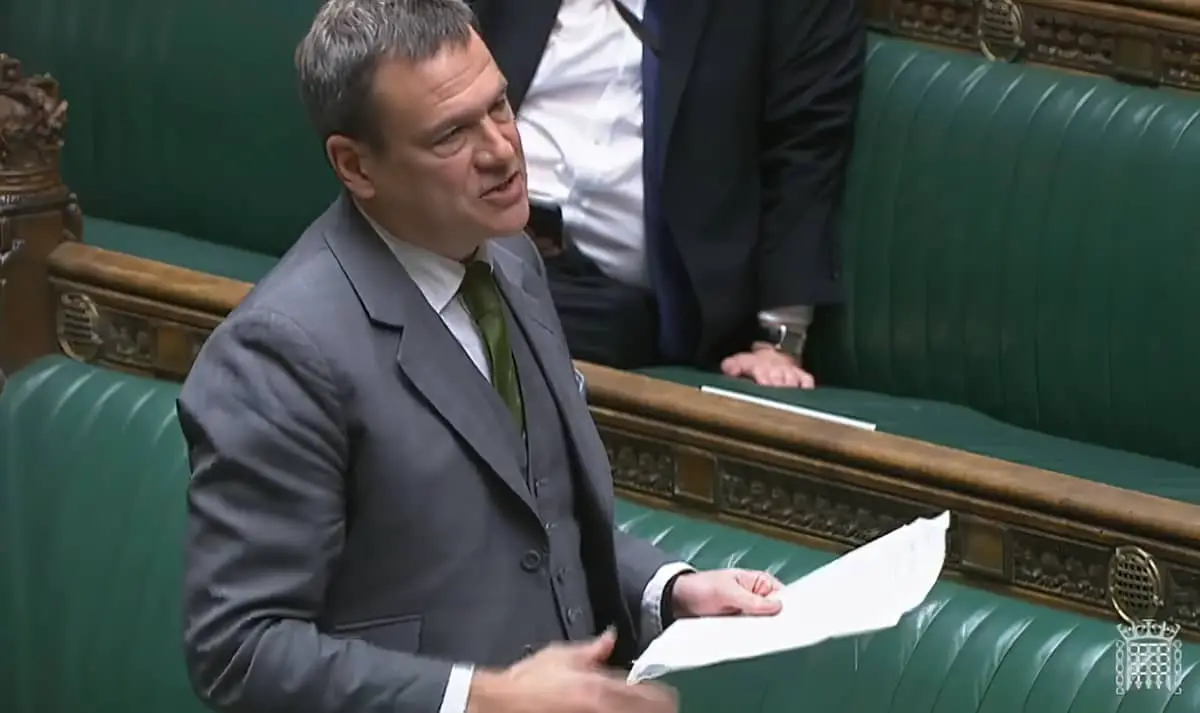

Isle of Wight Conservative MP, Bob Seely, voted against a windfall tax.

No 10 and Treasury split

Since News OnTheWight asked the questions (below) to Bob Seely late yesterday, political journalists on the Nationals are reporting today that there’s a divide between Rishi Sunak and Boris Johnson.

With the Treasury having asked MPs to abstain in the vote, meaning the Windfall Tax would have been gathered – with The Times reporting the argument was that it would send a powerful message to the public that the Government was “on their side” – while No 10 opposed it was “ideologically unconservative.”

Seely: “Unlikely to make a significant difference”

In Bob Seely’s response (in full below), he says he thinks the money from the windfall tax would be unlikely to make a significant difference, claiming, “there may be much better ways of helping people.”

Questions and answer

News OnTheWight asked Isle of Wight MP Bob Seely:

The inevitable question about your voting yesterday:

1) Would you please explain to Islanders your reasoning on why you voted against the amendment to the Queen’s Speech, which called for a windfall tax on the profits of oil and gas companies to support families struggling to pay energy bills.

2) Oil and gas companies are making record profits at a time when energy prices are pushing ever higher. Are you for or against a windfall tax on oil and gas companies?

He chose not directly answer the two questions posed, replying as follows instead:

“The cost of living crisis, and the cost of basic goods, is a significant issue for Island families. Rishi Sunak and other ministers are looking at the best ways that they can help lighten the problem.

“Windfall taxes occasionally work, but to argue that a windfall tax will solve our cost of living problem may not be the case, and there may be much better ways of helping people; hence the Government’s reluctance. For example, increasing the warm homes discount and cutting tax may be much more effective in helping families than a windfall tax.

“My worry about a windfall tax is that it would be unlikely to make a significant difference, and levying it would hit pension funds that pay the pensions of millions of people. It would also potentially deter investment in both renewables and North Sea oil and gas.

“The money may be better used to invest in oil and gas in the North Sea as well as the many renewable schemes that the major oil firms are investing in, in order to increase the energy supply and lower the cost to families in the UK.

“More investment in renewables means more work for Vestas on the Isle of Wight and potentially orders for more vessels to service those wind farms.

“As part of better ways to help families the Government could be looking at lowering taxes.

“For example, 25 percent of energy bills are in the form of green taxes. Perhaps we could reduce some of these, if only temporarily? In addition, a very sizeable chunk of the cost of petrol is tax. Could the Government reduce that? Or could Government reduce taxes, which are frankly too high.

“I know the Government is looking at options. We need to find the best ideas to help families through the coming months.”