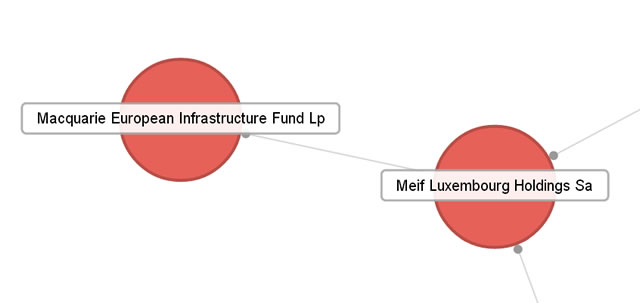

This in from Andrew Turner, in the words of his office. Shortly before publishing we contacted Wightlink and asked them for a comment. We’ve added a diagram to the bottom of the story to show the structure of Wightlink’s ownership – Ed.

Andrew Turner, the Island’s MP is calling on Macquarrie Bank, the Australian owners of Wightlink Ferries to come clean on the complicated funding arrangements behind the Cross-Solent ferry operator.

At a public meeting last week at St George’s Football Club, Peter Bonnell an accountant and Yarmouth resident raised the issue of expensive inter-company loans burdening the owners of the ferry company which has recently cut overnight services citing economic pressures.

Andrew Turner, commented:

“I have followed up the points Mr Bonnell raised and looked into the issue further.

Parent paid “£40 million a year in interest”

“Wightlink’s most recent accounts were filed in December and show a profit of £8.6 million. However the company that owns them, MEIF Shipping made a loss of over £44 million. That is because they are paying another Macquarrie company interest on a £273 million loan at an unbelievable rate of 17%; that amounts to more than £40 million a year in interest. They will be getting tax relief on those payments in the UK, and in total, companies in the group could be claiming around £8 million in tax refunds.

“It is not clear from these accounts who is the ultimate beneficiary of the £40 million. It is entirely possible it is being paid to a foreign based company in order to minimise liability for tax. To be clear I am not suggesting this is illegal; but it is certainly not clear which companies are involved in this financial chain or where they pay tax. Amazon, Starbucks, Google and other multi-national giants have been heavily criticised for such activities and I would like to know whether Macquarrie Group are also involved in such complex tax avoidance strategies.

“May effectively not even be paying UK tax on their profits”

“Islanders pay a great deal of money for their ferry services; out of their taxed income. When services are being cut because of economic pressures we need to know if those pressures are in large part caused because unrealistic interest payments between companies in the Group. To add insult to injury they may effectively not even be paying UK tax on their profits. To put this 17% interest rate into context, the Bank of England Base rate is currently 0.5% and some credit cards offer interest rates of less than 10%. It is not often you can say a loan would be far cheaper on a credit card!

“I am writing to the Macquarrie Group to ask them to come clean about which of their companies loaned MEIF the money, why the interest rate is so high and where the ultimate recipient company is based for tax purposes. When I receive a reply I will release it to the media.”

Company structure

To help you understand the structure of the ownership of Wightlink, On The Wight has added this organisational graphic. Click on images to see the full-sized version.